Good Tax Policy: Adequate

Good Tax Policy: Adequate

There are three main principles that we should think about when considering a tax code:

Growth in Kentucky’s general fund has not kept up with the growth in our economy — as our population has increased and as inflation has increased the cost of goods and services, our tax revenues have simply not kept pace, eroding our ability to invest in our communities. This has happened because our tax code is riddled with exemptions and special rates, and hasn’t been modernized enough to effectively tax the growing sectors of our economy. If our tax revenues were the same portion of personal income as they were in 1991, then we would have $2.6 billion more to invest in our communities this year alone.

If our tax code were adequate, we would have enough revenue year after year to make investments in our communities that benefit all Kentuckians while growing our economy.

For our tax code to be adequate, it must include a mix of taxes that provide a stable, predictable base over the long term, and that grow in lockstep with the growth of our economy.

The recent tax changes enacted by the General Assembly move us away from having a more adequate tax code over the long term. Yes, the recent changes will provide more revenue in the short term because the sales tax was applied to many new services. However, most of the money raised by the tax on services was used to cut the top income tax rate for individuals and corporations, and to provide other breaks for corporations. Since the income tax is the revenue source that most closely tracks our economy, these changes will likely mean that we will continue to struggle to have the revenues that we need to make adequate investments.

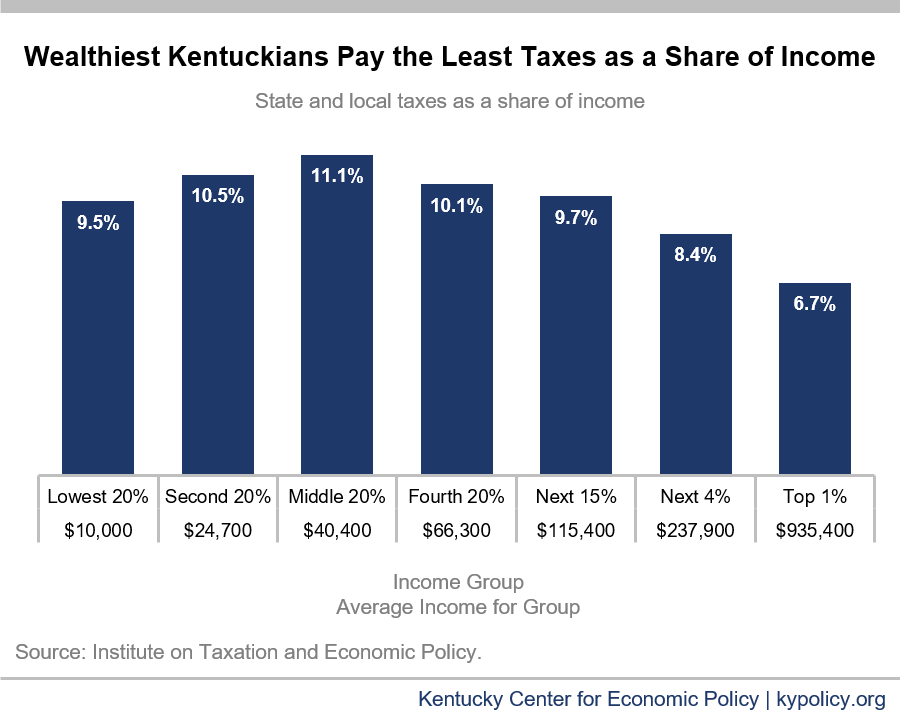

Kentucky legislators can roll back harmful tax cuts that benefited the wealthy and larger corporations in order to move towards a more adequate revenue code to ensure investments are made to benefit us all.

Growth in Kentucky’s general fund has not kept up with the growth in our economy — as our population has increased and as inflation has increased the cost of goods and services, our tax revenues have simply not kept pace, eroding our ability to invest in our communities. This has happened because our tax code is riddled with exemptions and special rates, and hasn’t been modernized enough to effectively tax the growing sectors of our economy. If our tax revenues were the same portion of personal income as they were in 1991, then we would have $2.6 billion more to invest in our communities this year alone.

If our tax code were adequate, we would have enough revenue year after year to make investments in our communities that benefit all Kentuckians while growing our economy.

For our tax code to be adequate, it must include a mix of taxes that provide a stable, predictable base over the long term, and that grow in lockstep with the growth of our economy.

The recent tax changes enacted by the General Assembly move us away from having a more adequate tax code over the long term. Yes, the recent changes will provide more revenue in the short term because the sales tax was applied to many new services. However, most of the money raised by the tax on services was used to cut the top income tax rate for individuals and corporations, and to provide other breaks for corporations. Since the income tax is the revenue source that most closely tracks our economy, these changes will likely mean that we will continue to struggle to have the revenues that we need to make adequate investments.

Kentucky legislators can roll back harmful tax cuts that benefited the wealthy and larger corporations in order to move towards a more adequate revenue code to ensure investments are made to benefit us all.

- Is it adequate?

- Is it sustainable?

- Is it equitable?

What is “adequate”?

An adequate tax code raises enough revenue to make right-sized investments in our communities. This means different things to different people, but after 20 rounds of budget cuts totaling more than $2 billion since 2008, there is widespread agreement that our current sources of revenue are not adequate. Here are just a few of the cuts that some programs have experienced since 2008, in inflation-adjusted numbers:- Core school funding for K-12 cut 16%

- State universities and community colleges cut 35%

- Department for Behavioral Health and Intellectual Disabilities cut 25%

- Family Resource and Youth Services Centers (FRYSCs) cut 16%

Why isn’t our tax code adequate?

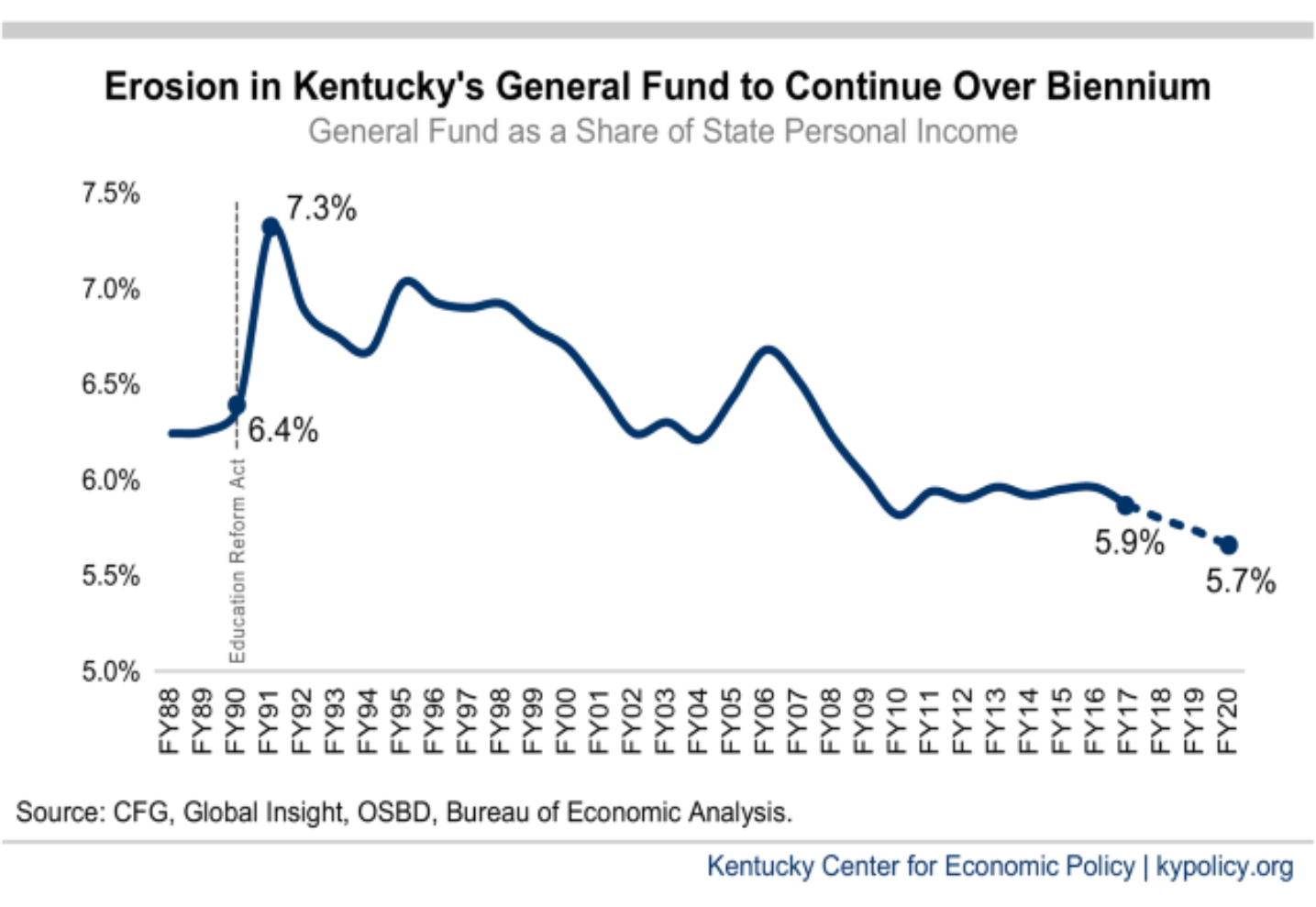

This graph shows why the successive rounds of budget cuts we’ve experienced have been necessary. Growth in Kentucky’s general fund has not kept up with the growth in our economy — as our population has increased and as inflation has increased the cost of goods and services, our tax revenues have simply not kept pace, eroding our ability to invest in our communities. This has happened because our tax code is riddled with exemptions and special rates, and hasn’t been modernized enough to effectively tax the growing sectors of our economy. If our tax revenues were the same portion of personal income as they were in 1991, then we would have $2.6 billion more to invest in our communities this year alone.

If our tax code were adequate, we would have enough revenue year after year to make investments in our communities that benefit all Kentuckians while growing our economy.

For our tax code to be adequate, it must include a mix of taxes that provide a stable, predictable base over the long term, and that grow in lockstep with the growth of our economy.

The recent tax changes enacted by the General Assembly move us away from having a more adequate tax code over the long term. Yes, the recent changes will provide more revenue in the short term because the sales tax was applied to many new services. However, most of the money raised by the tax on services was used to cut the top income tax rate for individuals and corporations, and to provide other breaks for corporations. Since the income tax is the revenue source that most closely tracks our economy, these changes will likely mean that we will continue to struggle to have the revenues that we need to make adequate investments.

Kentucky legislators can roll back harmful tax cuts that benefited the wealthy and larger corporations in order to move towards a more adequate revenue code to ensure investments are made to benefit us all.

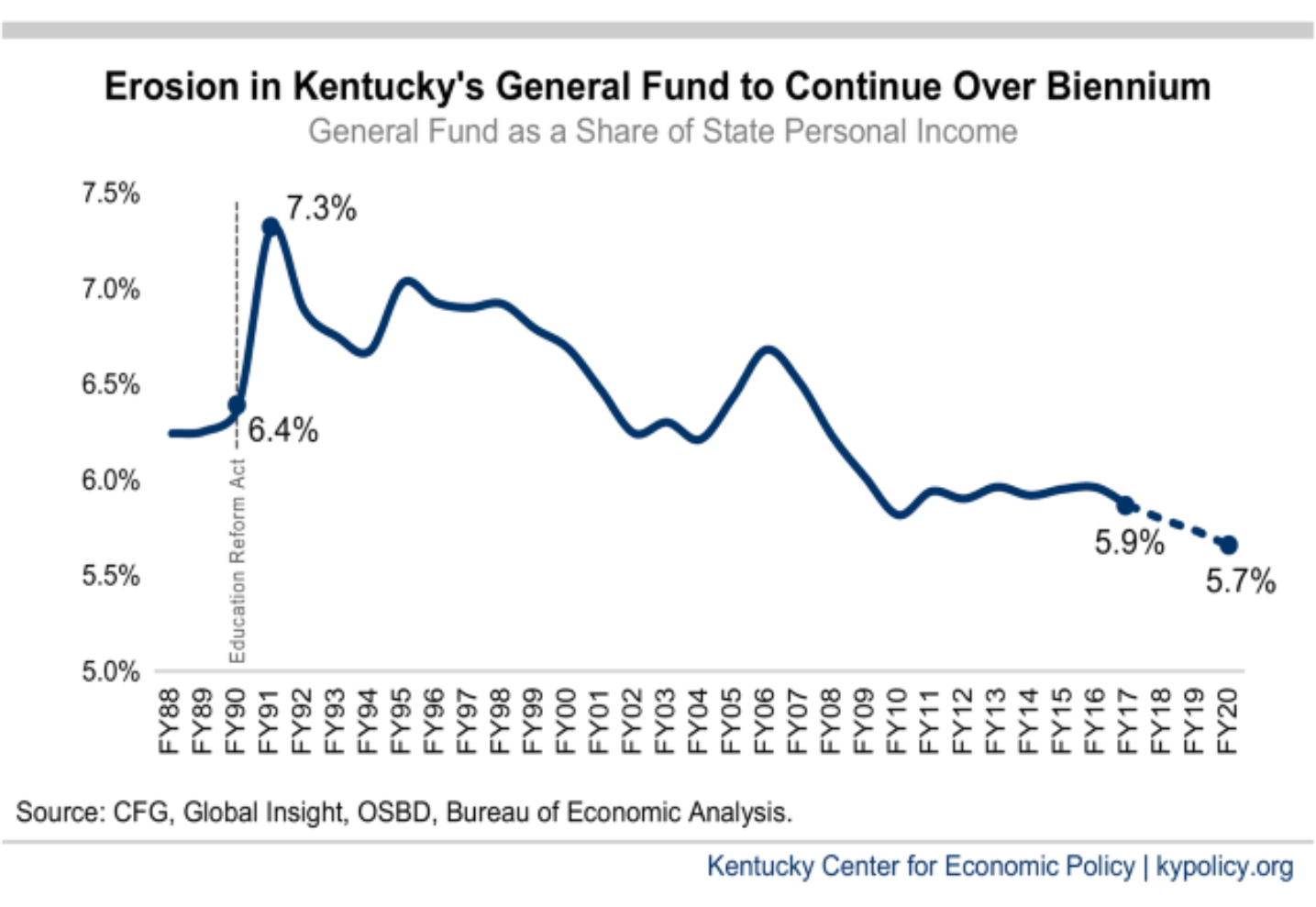

Growth in Kentucky’s general fund has not kept up with the growth in our economy — as our population has increased and as inflation has increased the cost of goods and services, our tax revenues have simply not kept pace, eroding our ability to invest in our communities. This has happened because our tax code is riddled with exemptions and special rates, and hasn’t been modernized enough to effectively tax the growing sectors of our economy. If our tax revenues were the same portion of personal income as they were in 1991, then we would have $2.6 billion more to invest in our communities this year alone.

If our tax code were adequate, we would have enough revenue year after year to make investments in our communities that benefit all Kentuckians while growing our economy.

For our tax code to be adequate, it must include a mix of taxes that provide a stable, predictable base over the long term, and that grow in lockstep with the growth of our economy.

The recent tax changes enacted by the General Assembly move us away from having a more adequate tax code over the long term. Yes, the recent changes will provide more revenue in the short term because the sales tax was applied to many new services. However, most of the money raised by the tax on services was used to cut the top income tax rate for individuals and corporations, and to provide other breaks for corporations. Since the income tax is the revenue source that most closely tracks our economy, these changes will likely mean that we will continue to struggle to have the revenues that we need to make adequate investments.

Kentucky legislators can roll back harmful tax cuts that benefited the wealthy and larger corporations in order to move towards a more adequate revenue code to ensure investments are made to benefit us all.