There are three main principles we should think about when considering how our tax code provides revenue for vital investments in our state:

- Is it adequate?

- Is it sustainable?

- Is it equitable?

In Kentucky’s case, the answer to all three of these questions is ‘no.’

We’ve already taken a look at adequacy. In this post, we’ll take a look at why our tax code is unsustainable and why a recent tax law has made it even less so.

A sustainable tax code produces revenue that grows with the economy — with the need for investments (population growth) and the cost of investments (inflation). If a tax code reliably produces adequate revenue growth, big changes to tax laws are unnecessary, allowing for businesses and individuals to better predict their own costs.

Budget crises come about when the revenue fails to keep up with the cost of needed investments — like those in education, healthcare, child protection and infrastructure. In April, the Kentucky tax code was altered in ways that raised $200 million for slightly more funding for programs in budget crisis — like child protection, state police and the public defender’s office. There was a clear acknowledgment that our revenue is not adequate. However, the tax changes shifted our tax code toward reliance on less sustainable sources of revenue, increasing the likelihood of more budget crises down the road.

What makes a tax code unsustainable?

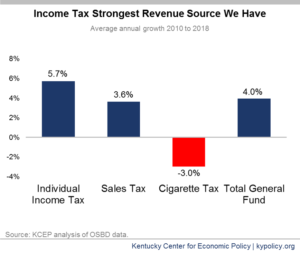

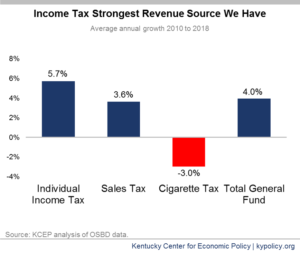

Unsustainable tax codes come about for two reasons — too many special interest tax breaks that grow in size over time, and an over reliance on slow-growing revenue sources. Even though the 2018 tax changes cleaned up some of these special interest tax breaks, many remain, and the new tax code shifts away from faster-growing income taxes towards slower-growing sales taxes and declining cigarette taxes.

Put simply – it’s impossible to sustain vital investments if revenue does not keep up with the economy.

Good tax policy includes a strong income tax and diverse other sources of revenue with few special interest tax breaks. This means more reliable and predictable revenue for investments in good and bad economic times that help all Kentuckians, our communities and our businesses to grow and prosper.

Put simply – it’s impossible to sustain vital investments if revenue does not keep up with the economy.

Good tax policy includes a strong income tax and diverse other sources of revenue with few special interest tax breaks. This means more reliable and predictable revenue for investments in good and bad economic times that help all Kentuckians, our communities and our businesses to grow and prosper.