Kentucky’s tax code 25th most inequitable after 2018 tax bill

Kentucky’s tax code 25th most inequitable after 2018 tax bill

After legislative changes that raised sales taxes to pay for individual and corporate income tax rate cuts that mostly benefited the wealthiest Kentuckians, our ranking among states fell nine spots from 34th to 25th for most inequitable tax codes.

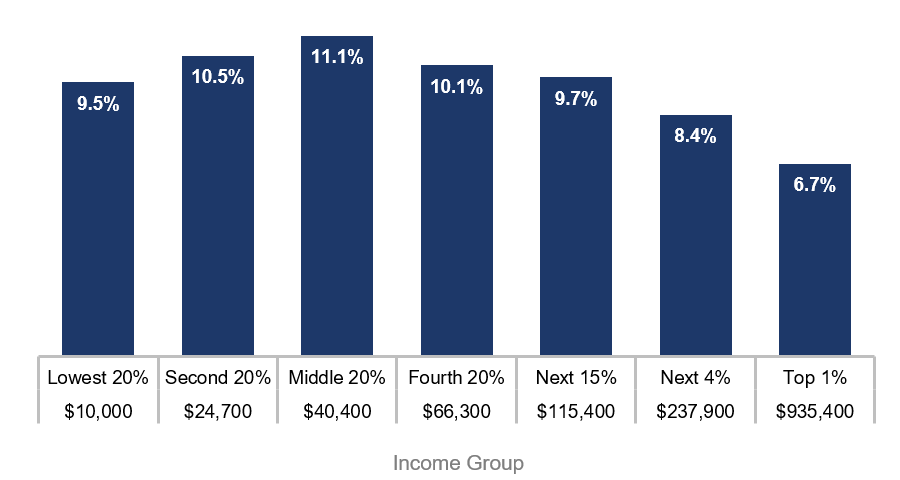

Inequitable, or ‘upside-down,’ tax codes ask less of those with more money and more of those with less. In other words, Kentucky families struggling to get by pay more in taxes as a share of their income than the wealthiest of households. Kentucky’s tax code became even more inequitable in 2018 after the legislature eliminated our graduated income tax and went to a flat tax. A graduated income tax asks more from those who have more by levying higher rates on higher levels of income, while a flat tax asks the same from everyone, despite ability to pay.

In considering the major taxes included in an overall tax system, a graduated income tax can help to even out the regressive effects of state sales taxes and local utility taxes, which are similar to flat income taxes because everyone pays the same rate regardless of the ability to pay.

When a household only has $10,000 in income per year, as is the case with the bottom 20% of Kentucky households on average, that household will likely spend every penny simply to get by. The taxes levied on those purchases have a much bigger impact on the ability of that household to make ends meet. In comparison, a household with $935,000 in income, which is the average annual income of the top 1 percent, doesn’t have to spend every penny to make ends meet, and there is much more flexibility in the budget so that the payment of taxes doesn’t result the same difficult choices faced by those in the bottom 20%.

The bottom line is that the 2018 tax changes mean that middle- and low-income Kentuckians will have to chip in the most toward the investments that benefit us all, while the wealthiest Kentuckians chip in the least.