Report Shows Special Interests Prioritized Over Our Commonwealth

Report on Kentucky State Budget

January 22, 2016Years of Constant Budget-Cutting Show Kentucky Needs More Revenue

February 9, 2016Report Shows Special Interests Prioritized Over Our Commonwealth

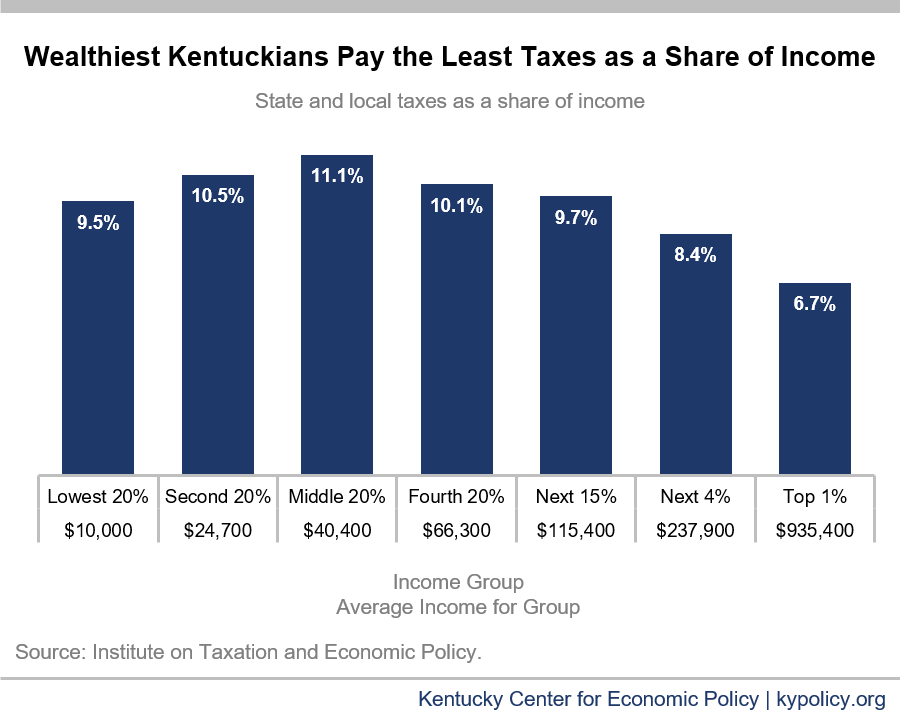

The taxes we pay in Kentucky are invested in things that make us stronger together like schools, libraries, roads and parks, to name a few. When we all chip in, we share the benefits of an educated, healthy workforce and thriving communities.

But due to an ever-expanding set of special interest carve-outs, we have less to invest. In fact, tax breaks are growing so big in the Commonwealth that the money we leave on the table through various exemptions, exclusions, deductions and credits surpasses the revenue we collect from all people and businesses – an estimated $12.2 billion in tax breaks versus $10.3 billion in revenue in 2016.

That cost estimate comes from the state’s recently released tax expenditure report, a vitally important but rarely acknowledged document detailing all of Kentucky’s tax breaks. It was released at the end of November with little ado.

As we head into the 2016 budget session of the General Assembly with lawmakers scrambling to balance a budget with too little revenue, it’s time we begin looking at the billions we leave untouched in tax breaks – $25.7 billion over the coming biennium – and ask whether some part of that money might be better spent.

According to data from the budget office, the state will need hundreds of millions of dollars more than we expect in new revenue in the next two years just to pay for growth in school population, inflation across state services and pension obligations. That doesn’t include additional investments to restore past budget cuts or improve services. But in the context of tens of billions in lost revenue from tax breaks, the dollars it will take to meet our basic needs and to start living up to our potential is not out of reach.

Simplifying our taxes by limiting tax breaks would give us more revenue to invest in the things that make Kentucky a good place to live, work, raise families and do business. On the other hand, the idea that more and more tax breaks make us attractive compared to other states is misguided, race-to-the-bottom logic: in practice, too many tax breaks erode investments in the very building blocks of a strong economy and prosperous communities.

In addition to reducing or eliminating specific breaks that aren’t cost-effective and beneficial to the state as a whole, lawmakers should also routinely evaluate all tax breaks. Renewal should be based on results, instead of the current practice of adding them to the tax code where they remain for good (or bad). The current lack of scrutiny on tax breaks is a double-standard: even though they have the same effect on our budget as direct spending, they aren’t weighed against budgeted priorities like K-12 funding, community mental health centers and aging and independent living supports. That is why we continue to cut budgeted services – 14 rounds of cuts in this state since 2007 – even as tax breaks proliferate.

The tax expenditure report is an important tool. In a sense, it’s a menu of tax reform options at lawmakers’ fingertips. By speaking up about how we do better when everyone chips in, we can encourage Frankfort to clean up the tax code and allow us to better invest in the things that make us strong.

So pick up the report, tell a friend, write a letter and make a call: I want to live in a Commonwealth where we prioritize investments in our shared prosperity over hidden tax breaks that get little or no scrutiny.