Good Tax Policy: Equitable

There are three main principles we should think about when considering how our tax code provides revenue for vital investments in our state:

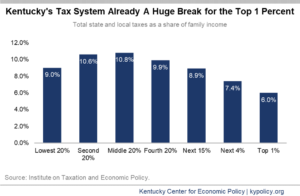

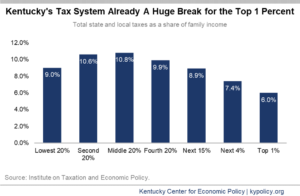

As illustrated above, families in the top 20% (combining the three bars on the right) pay proportionately less in state and local taxes than families in the bottom 80%. Families in the bottom 20% with average incomes of $12,000, pay 9% of their income in state and local taxes, while those in the top 1%, with incomes of over $1 million, pay just 6% of their income in state and local taxes. Significant changes to our tax code made by the 2018 General Assembly will make this situation even worse than it was in 2017 going forward.

By asking less of those with more, we give a huge tax break to those at the top, we increase income inequality, and we limit the sustainability and adequacy of our tax code.

As illustrated above, families in the top 20% (combining the three bars on the right) pay proportionately less in state and local taxes than families in the bottom 80%. Families in the bottom 20% with average incomes of $12,000, pay 9% of their income in state and local taxes, while those in the top 1%, with incomes of over $1 million, pay just 6% of their income in state and local taxes. Significant changes to our tax code made by the 2018 General Assembly will make this situation even worse than it was in 2017 going forward.

By asking less of those with more, we give a huge tax break to those at the top, we increase income inequality, and we limit the sustainability and adequacy of our tax code.

If our tax code were equitable by asking those with more to chip in more, we would have enough revenue year after year to make the investments in our communities that benefit all Kentuckians. With greater investments in education, infrastructure and more, we would be building the foundations of an economy that works for all and grows as a result.

If our tax code were equitable by asking those with more to chip in more, we would have enough revenue year after year to make the investments in our communities that benefit all Kentuckians. With greater investments in education, infrastructure and more, we would be building the foundations of an economy that works for all and grows as a result.

- Is it adequate?

- Is it sustainable?

- Is it equitable?

What is “equitable”?

An equitable tax code means that we’re all asked to chip in for the public investments (like schools, libraries, public safety, infrastructure and so much more) that we all benefit from according to our ability to pay. Simply stated – those who have more are asked to pay more.Kentucky is upside down

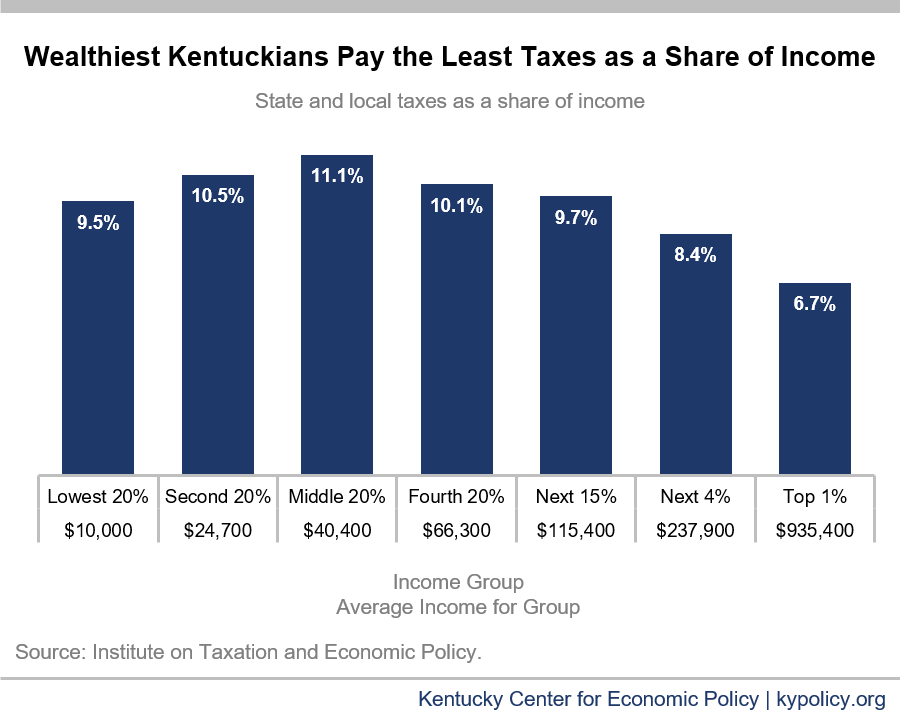

Kentucky’s tax code as of 2017 was already upside down, meaning those at the top paid less as a share of their income than those at the bottom. As illustrated above, families in the top 20% (combining the three bars on the right) pay proportionately less in state and local taxes than families in the bottom 80%. Families in the bottom 20% with average incomes of $12,000, pay 9% of their income in state and local taxes, while those in the top 1%, with incomes of over $1 million, pay just 6% of their income in state and local taxes. Significant changes to our tax code made by the 2018 General Assembly will make this situation even worse than it was in 2017 going forward.

By asking less of those with more, we give a huge tax break to those at the top, we increase income inequality, and we limit the sustainability and adequacy of our tax code.

As illustrated above, families in the top 20% (combining the three bars on the right) pay proportionately less in state and local taxes than families in the bottom 80%. Families in the bottom 20% with average incomes of $12,000, pay 9% of their income in state and local taxes, while those in the top 1%, with incomes of over $1 million, pay just 6% of their income in state and local taxes. Significant changes to our tax code made by the 2018 General Assembly will make this situation even worse than it was in 2017 going forward.

By asking less of those with more, we give a huge tax break to those at the top, we increase income inequality, and we limit the sustainability and adequacy of our tax code.

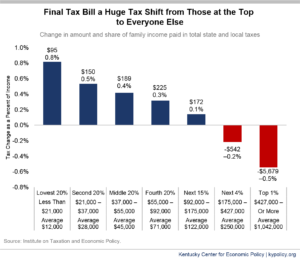

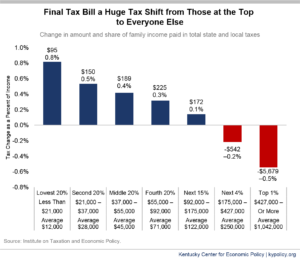

The New Tax Law’s Effect on Inequities

With significant changes in Kentucky’s tax laws beginning in 2018, households at different income levels will be impacted differently. There are two major changes for individuals:- Sales and cigarette taxes: All Kentuckians who purchase a gym membership, take their car in for repairs, visit vet or pet groomer, or hire a landscaping company (among other services) will now pay sales tax. (A more complete list is available here). The cigarette tax was also raised by 50 cents. On the whole, these changes will negatively impact people on the lower end of the income scale more than those on the upper end.

- Individual income tax: The individual income tax, which used to range from 2%-6% on a graduated basis, will now be 5% for all income – a flat tax. There is a lot that determines who pays what when it comes to the individual income tax, but a general principle holds true with this change – lowering and flattening the income tax rate means a huge tax cut for the wealthy, and a tax increase for some in the lower income brackets.

If our tax code were equitable by asking those with more to chip in more, we would have enough revenue year after year to make the investments in our communities that benefit all Kentuckians. With greater investments in education, infrastructure and more, we would be building the foundations of an economy that works for all and grows as a result.

If our tax code were equitable by asking those with more to chip in more, we would have enough revenue year after year to make the investments in our communities that benefit all Kentuckians. With greater investments in education, infrastructure and more, we would be building the foundations of an economy that works for all and grows as a result.