Two Graphs Explain Why Kentucky Has Less to Invest

More Funding for Mental Health Needed to Build Healthier, More Productive Lives

February 10, 2016

Child Care Assistance Key to Building Strong Communities

February 16, 2016Two Graphs Explain Why Kentucky Has Less to Invest

The revenue we have to invest in Kentucky almost always grows, year over year. The current forecast predicts the state will collect about $320 more in 2016 than it did in 2015.

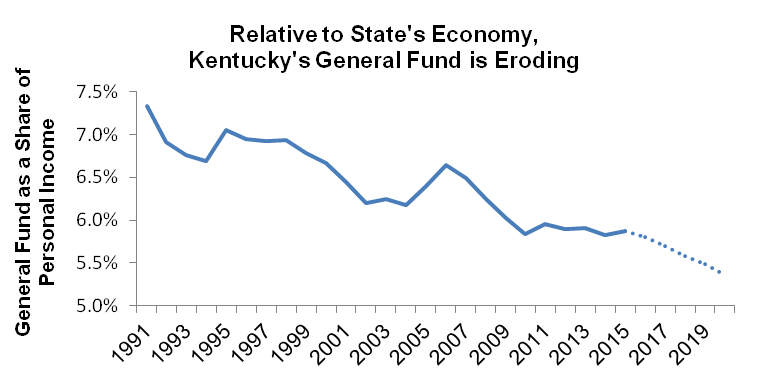

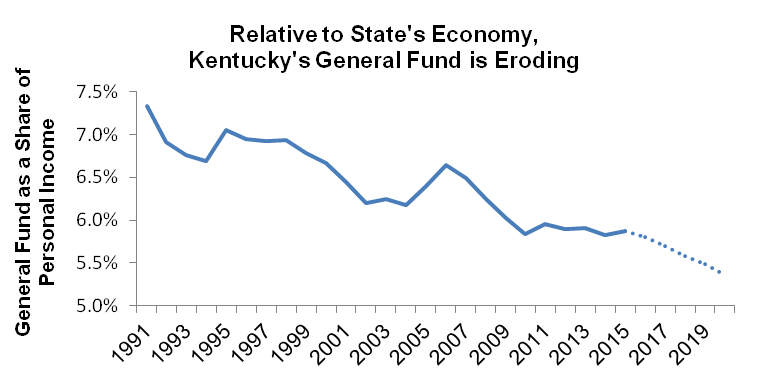

Yet when you compare the resources we have to the size of our economy – which is directly related to what it takes to maintain investments in education, health and other crucial services for thriving communities – we see that the revenue we have to invest in Kentucky is actually shrinking and will continue to do so.

Source: Bureau of Labor Statistics, Congressional Budget Office, Office of the State Budget Director

If, instead of shrinking, General Fund Revenue had just held constant as a share of the economy at 7.3 percent since 1991 (after the Kentucky Educational Reform Act was passed), we would have had $2.4 billion more in 2015 to invest in a stronger Kentucky for all of us.

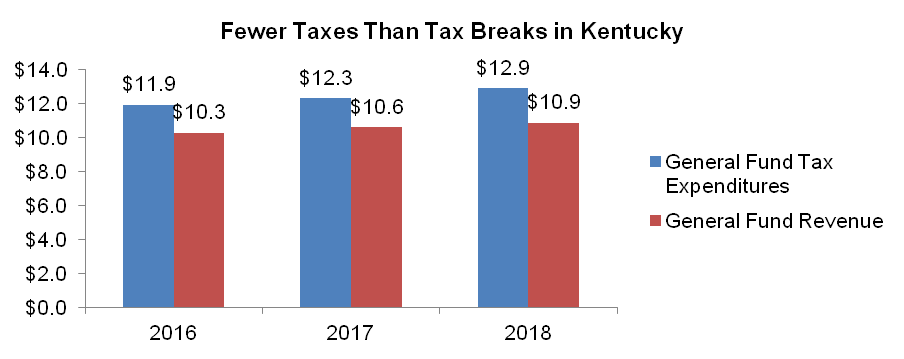

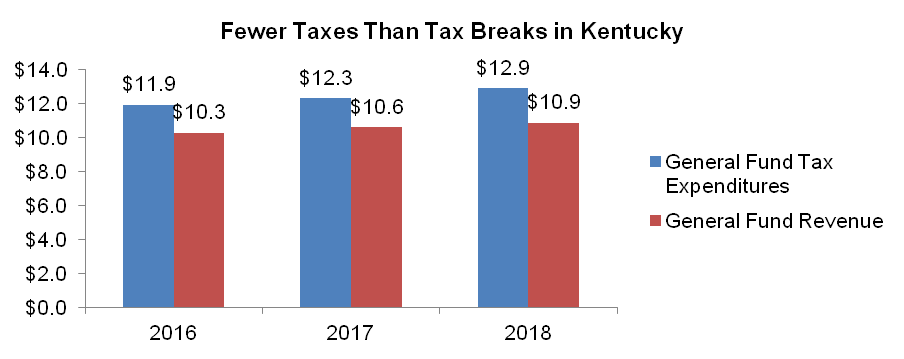

What features of our tax system are so out of sync with our economy that we have this erosion? Kentucky’s tax expenditure report describes a growing list of tax breaks – holes in our tax code – that are draining revenue and leaving us with less to invest. The problem is so big that we give out more in tax breaks than we collect in revenue each year. That means less for our schools, colleges and universities, day cares, community mental health centers, social workers and more. It’s time to bring some balance back into our system, clean up tax breaks and invest more in a stronger state.

Source: Bureau of Labor Statistics, Congressional Budget Office, Office of the State Budget Director

If, instead of shrinking, General Fund Revenue had just held constant as a share of the economy at 7.3 percent since 1991 (after the Kentucky Educational Reform Act was passed), we would have had $2.4 billion more in 2015 to invest in a stronger Kentucky for all of us.

What features of our tax system are so out of sync with our economy that we have this erosion? Kentucky’s tax expenditure report describes a growing list of tax breaks – holes in our tax code – that are draining revenue and leaving us with less to invest. The problem is so big that we give out more in tax breaks than we collect in revenue each year. That means less for our schools, colleges and universities, day cares, community mental health centers, social workers and more. It’s time to bring some balance back into our system, clean up tax breaks and invest more in a stronger state.

Source: Office of the State Budget Director

Source: Office of the State Budget Director

Source: Bureau of Labor Statistics, Congressional Budget Office, Office of the State Budget Director

If, instead of shrinking, General Fund Revenue had just held constant as a share of the economy at 7.3 percent since 1991 (after the Kentucky Educational Reform Act was passed), we would have had $2.4 billion more in 2015 to invest in a stronger Kentucky for all of us.

What features of our tax system are so out of sync with our economy that we have this erosion? Kentucky’s tax expenditure report describes a growing list of tax breaks – holes in our tax code – that are draining revenue and leaving us with less to invest. The problem is so big that we give out more in tax breaks than we collect in revenue each year. That means less for our schools, colleges and universities, day cares, community mental health centers, social workers and more. It’s time to bring some balance back into our system, clean up tax breaks and invest more in a stronger state.

Source: Bureau of Labor Statistics, Congressional Budget Office, Office of the State Budget Director

If, instead of shrinking, General Fund Revenue had just held constant as a share of the economy at 7.3 percent since 1991 (after the Kentucky Educational Reform Act was passed), we would have had $2.4 billion more in 2015 to invest in a stronger Kentucky for all of us.

What features of our tax system are so out of sync with our economy that we have this erosion? Kentucky’s tax expenditure report describes a growing list of tax breaks – holes in our tax code – that are draining revenue and leaving us with less to invest. The problem is so big that we give out more in tax breaks than we collect in revenue each year. That means less for our schools, colleges and universities, day cares, community mental health centers, social workers and more. It’s time to bring some balance back into our system, clean up tax breaks and invest more in a stronger state.

Source: Office of the State Budget Director

Source: Office of the State Budget Director